Renting in Retirement Should Retirees Rent or Buy Their Homes

The decision of whether to rent or buy in or for retirement is a personal one that only you can answer for yourself, but if you're on the fence, Mathis suggests using a 5/25 general rule to start. "If a retiree can rent a home annually for less than 5% of the value of the home, they should rent (i.e. if a house is $500,000 but can be rented.

Retirement Signs Printable

While owning a home has long been associated with retirement security, renting can also offer numerous benefits. Here are seven reasons why renting a home in retirement can be a wise and rewarding choice: Flexibility in Location: Renting in retirement allows for greater flexibility in where you live. Without the long-term commitment of a.

How to Save for Retirement as a Stay At Home Mom Saving for retirement, Stay at home mom

In many markets, renting is cheaper each month than owning — at least in the near-term. Austin, Texas, was just ranked as one of the best places to retire, according to U.S. News & World Report. Austin's median rental listing price is $1,695 per month, while the median home for sale has a listing price of $389,000.

Retirement Planning Considerations for a StayatHome Spouse

7 Benefits of Renting a Home in Retirement. Emmet Pierce. Updated Thu, Sep 16, 2021, 5:00 AM. Link Copied. 0.. There are several good reasons why billionaire investors like this ETF.

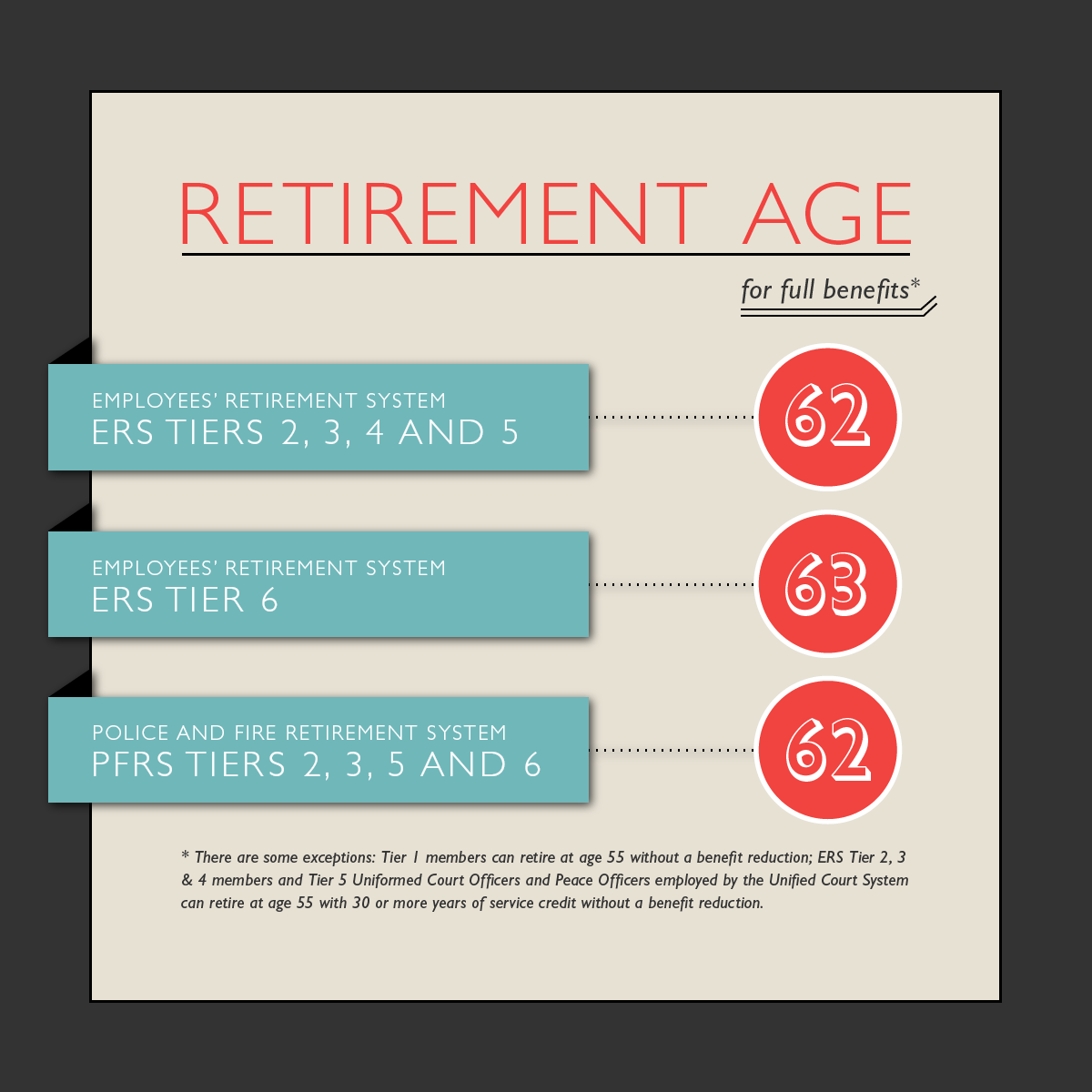

What Is Nycers Retirement And Benefits

People who sell long-term homes may be subject to taxes. Renting may be a better option for people who are relocating. Renting may also make sense for people who make multiple moves in retirement.

Cost of Renting vs. Owning a Home in Every State Rent, Rent vs buy, Reverse mortgage

7 Reasons You Should Rent A Home In Retirement As retirement approaches, many individuals face the decision of whether to rent or buy a home for their golden years. While owning a home may have been a lifelong dream for some, renting can offer numerous advantages that are particularly appealing during retirement. Here are seven […]

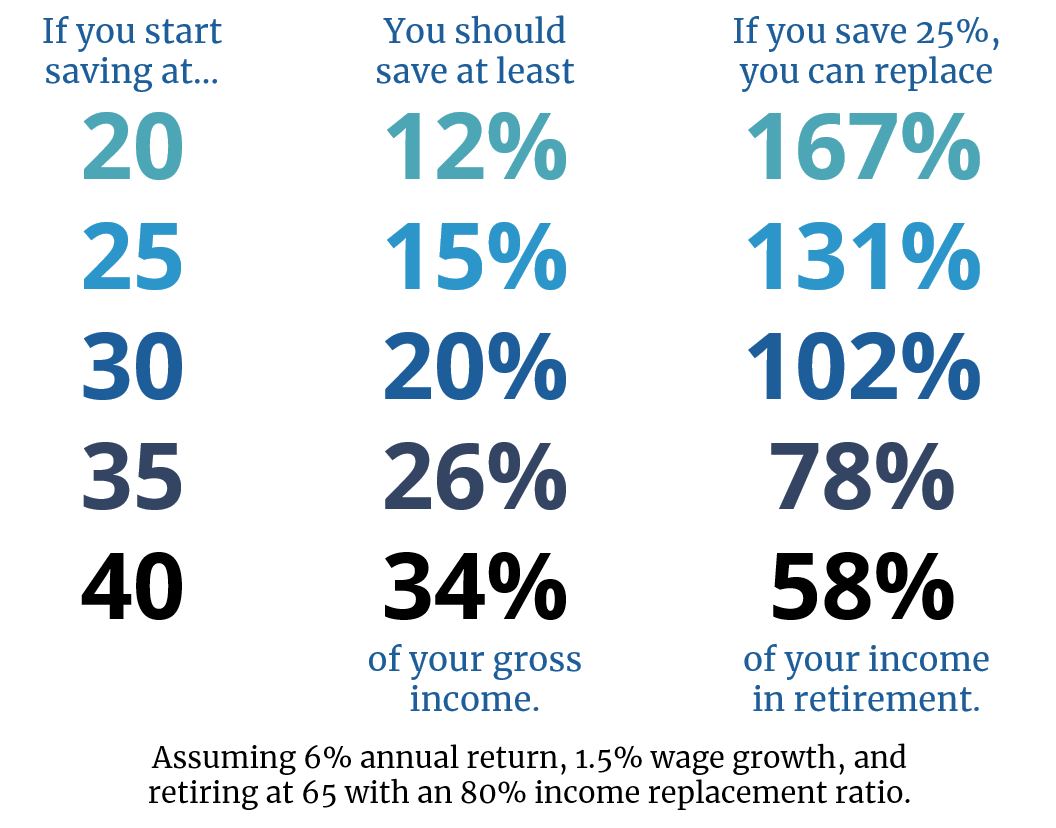

How Much Should I Be Saving for Retirement?

If you're "house rich and cash poor," selling your home could mean putting those funds into your retirement account, helping you to retire more comfortably. Let's say your home is worth.

5 Qualities that Make a Great Retirement Home Perfect Health Fit

Venturing into the golden chapter of retirement, we're met with decisions that shape our comfort and financial well-being. After years of nurturing a family home, the space may seem too sprawling for current needs—or perhaps there's an itch for new scenery.

Rent vs Buy Figure Out What Option Is Best For You Rent vs buy, Real estate infographic, Real

In this article, 7 Reasons to Rent vs Owning a Home in Retirement. This choice can have a profound impact on your financial well-being and overall quality of life.. In this article, we'll explore 7 reasons to rent vs owning a home in retirement. From the financial benefits to the increased flexibility, you'll discover why renting can.

When should I retire? — Yours

(If you bought your home before Dec. 16, 2017, you can still deduct interest on a $1-million-or-less mortgage under the previous law.) Meanwhile, the property tax deduction is now capped at $10,000.

4 Questions You Must Ask Before Deciding Where to Retire Boca Raton Florida, Last Will And

B) Simplify your life by eliminating maintenance requirements. C) Reduce your home upkeep and energy expenses. D) Address mobility issues that may arise during retirement. Renting a smaller property can also provide you with the freedom to test out a new location before committing to a "permanent" home purchase.

Own or Rent in Retirement YouTube

It is rare that I come across a retiree who doesn't have travel as a major line item in their annual budget. When I leave my own home for vacations, I check the HVAC, sump pump and outside.

How Much to Save for Retirement REALLY? Retirement Planning Saving for retirement

Gutters cleaning. Snow removal. Appliance repairs. Major home systems repairs and maintenance. Pest control. If you're renting in retirement, you won't have to worry about any of that - your landlord will. You also don't have to worry about a large part of your finances being tied up in one asset, which can be risky.

RETIREMENT Who Knows The Retiree Best Printables Depot

Here is the exclusive summary of 7 reasons you should rent a home in retirement: Renting a home in retirement offers flexibility and mobility, allowing retirees to explore new opportunities and locations. It reduces financial responsibility by shifting burdens such as maintenance and repairs to the landlord. Access to amenities and services in.

Should You Rent Or Own In Retirement? Blog

7 Reasons to Rent a Home in Retirement. October 9, 2023 by Melissa Batai. Part of the American Dream is to buy a home, pay it off before retirement, and live in it until you're no longer able to.

saving and retirement saving and retirement I am the desig… Flickr

Moreover, if you have a boatload of equity in the home, selling today and renting means you could pile your gains from the sale into your pot of retirement savings. The profit from the sale can make it easier to delay starting Social Security until age 70 to lock in the highest possible benefit. The first $250,000 in capital gains from the sale.

.